Let’s talk money. It’s one of those topics that can either make us feel empowered or completely overwhelmed. But what if we told you that developing healthy financial attitudes doesn’t have to be a daunting task? Yep, you heard it right. By incorporating mindful money habits into your daily life, you can take control of your finances and pave the way to financial freedom. So, grab a cup of coffee, and read on to learn how you can cultivate a healthier relationship with your money.

Understanding Your Relationship with Money

First things first, let’s take a moment to reflect on our relationship with money. Are you splurging on impulse purchases, or do you meticulously budget every penny? Understanding your money mindset is the first step towards making positive changes. Maybe you grew up in a household where money was a taboo topic, or perhaps you’ve always associated wealth with happiness. Whatever your background is, acknowledging your beliefs and attitudes towards money is key to transforming your financial habits.

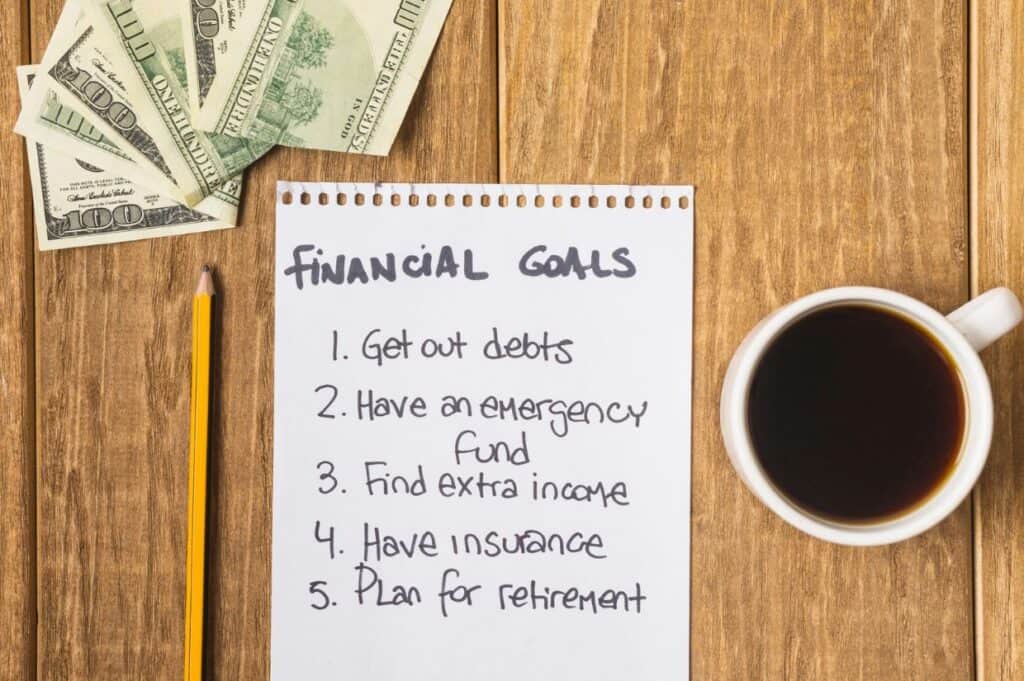

Setting Clear Financial Goals

Now that we’ve got a better grasp of our money mindset, it’s time to set some goals. Think of your financial goals as your roadmap to success. Whether you’re saving up for a dream vacation, aiming to pay off debt, or building an emergency fund, having clear objectives will keep you focused and motivated. Remember, your goals should be SMART: specific, measurable, achievable, relevant, and time-bound. So, grab a pen and paper (or your favorite note-taking app) and start jotting down your goals. Believe it or not, it’s incredibly satisfying to check them off one by one.

Creating a Budget That Works for You

The dreaded “B” word—budgeting. We get it, the thought of tracking every expense can be overwhelming, but I promise it’s not as scary as it seems. Budgeting is simply a way to ensure that you spend less than you earn and allocate your money toward your priorities. Start by tracking your income and expenses for a month to get a clear picture of where your money is going. From there, you can create a budget that aligns with your financial goals. And hey, don’t forget to build in some wiggle room for those occasional splurges—we’re only human, after all.

Practicing Mindful Spending

Speaking of splurges, let’s talk about mindful spending. Mindful spending is all about being intentional with your money and making purchases that bring you true happiness and fulfillment. Before swiping your card or clicking “Buy Now,” ask yourself: Do I really need this? Will it bring value to my life? Can I afford it without sacrificing my long-term goals? By pausing to reflect on your purchases, you’ll avoid impulse buys and save yourself from buyer’s remorse. Plus, you’ll appreciate the things you choose to buy even more.

Building an Emergency Fund

Life is full of unexpected twists and turns, which is why having an emergency fund is essential. An emergency fund acts as a safety net, providing you with financial security when the unexpected happens—whether it’s a car repair, medical bill, or job loss. Aim to save three to six months’ worth of living expenses in your emergency fund, and stash it away in a separate savings account for easy access. You’ll thank yourself later when life throws you a curveball.

Investing in Your Future

Now that we’ve covered the basics, let’s talk about investing in your future. Investing is one of the most powerful tools for building wealth over time, yet many people shy away from it due to fear or lack of knowledge. But fear not, investing doesn’t have to be complicated. Whether you’re contributing to a retirement account, dabbling in the stock market, or investing in real estate, the key is to start early and stay consistent. And remember, it’s okay to seek guidance from a financial advisor or do your own research to find the best investment strategy for you.

Practicing Gratitude

Last but certainly not least, let’s not forget to practice gratitude along the way. In a world that’s constantly bombarding us with messages of what we don’t have, it’s important to take a moment to appreciate what we do have. Whether it’s a roof over our heads, food on the table, or loved ones who support us, there’s always something to be thankful for. By cultivating an attitude of gratitude, we can shift our focus from scarcity to abundance and approach our finances with a sense of contentment and peace.

Wrapping Up

So there you have it—a crash course in developing healthy financial attitudes through mindful money habits. Remember, Rome wasn’t built in a day, and neither are healthy financial habits. It’s all about progress, not perfection. So take it one step at a time, be kind to yourself along the way, and before you know it, you’ll be well on your way to financial freedom. Cheers to a brighter financial future!